HOW TO HARNESS

SBADNA Forecast Model

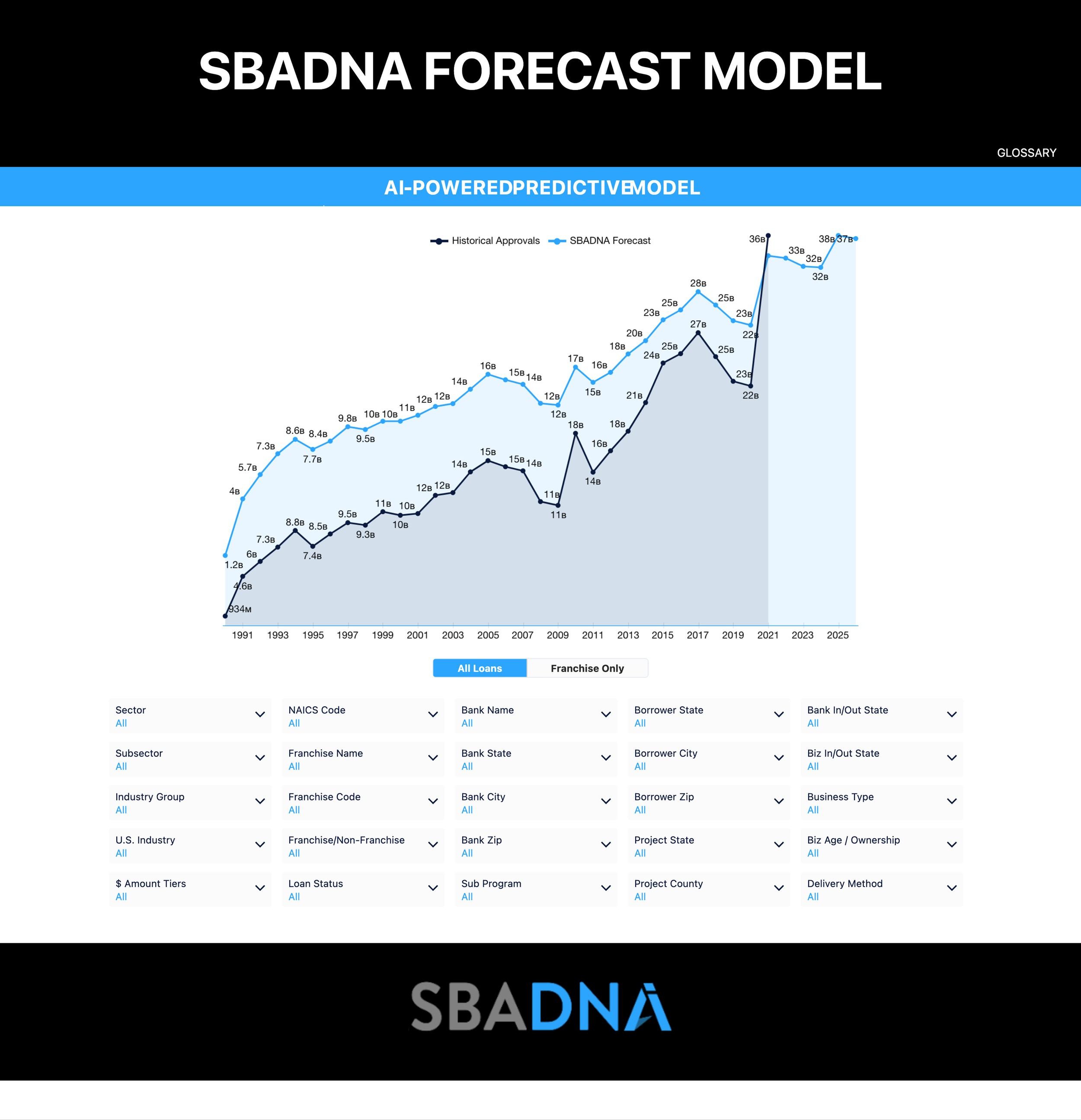

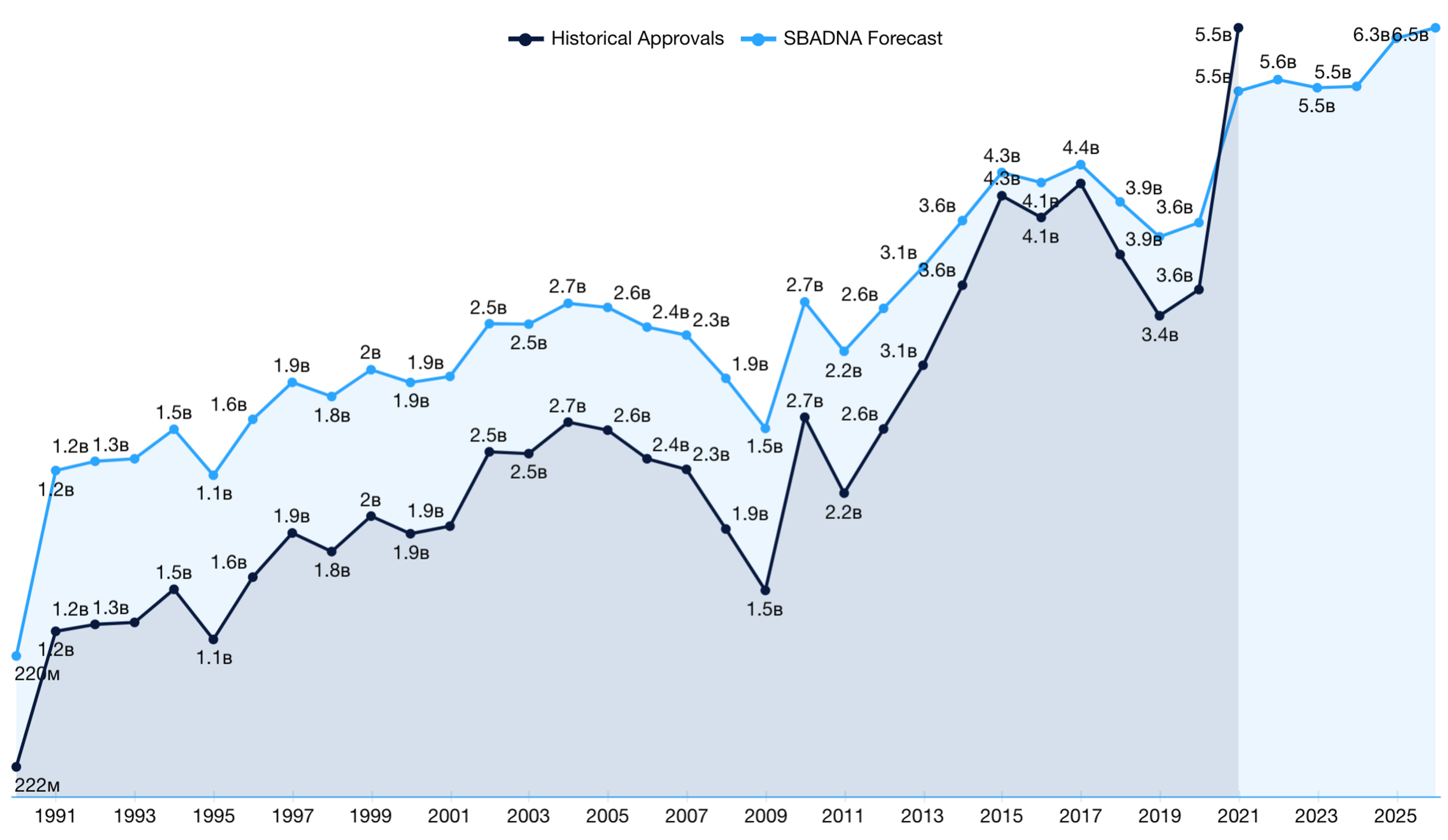

The SBADNA Forecast is a timeline series forecast chart.

It is located as a large chart in Trends > Forecast Model. It is also incorporated into some of the other dashboards.

Our time series forecast uses the Holt-Winters Forecasting Model with Triple Exponential Smoothing. The forecast is calculated as a weighted average of all historical data with recent data being weighted exponentially higher than older data.

Is it a crystal ball? No, our forecast model is much faster than a crystal ball, easier to operate, and accessible online 24/7.

There are numerous ways to utilize the forecast model to harness intel. Here are some of the key ways for how to utilize and harness intel from the forecast model.

HOW TO OPERATE

Before we jump into how to use and harness let’s summarize how to operate the forecast model. The forecast model is perhaps the easiest of all the Intel Dashboards to operate.

The time series forecast method is based on either additive or multiplicative components. Our AI-powered platform internally calculates results by both algorithms and shows the best results of the two by calendar years, not fiscal.

Trajectory

Forecast

The historical forecast is displayed based on the algorithm that the AI-powered platform selects. It will vary slightly from the actual historical amounts but will typically be close.

The next few years are forecasted for loan approval amounts.

Like all the other charts and graphs, the forecast model is interactive. Scroll over any point to see a popup with the exact historical and forecasted amounts for that year.

There are 25 dropdown filters which are all interconnected. Use any combination of filters and use one or multiple selections within each filter. Remember the more you filter, the smaller the sample size. You can filter to the point of not having enough data to produce a robust chart.

Since this is a time series forecast, if there are only a few years of historical data (like a new lender or franchise brand) then the forecast may not generate a future amount or show with significant spikes.

HOW TO HARNESS

We’ll break out how to harness into different categories.

Lender Focused Forecasts

What does your bank’s forecast look like?

The very first thing to do in harnessing forecast intel is to see what your bank’s trajectory and forecast looks like. Check the forecast for your bank by using the Bank name drop down filter. What’s the overall forecast look like? What’s it look like for the key states, cities, industries, or franchise brands you focus on? In any of these combinations?

BYLINE BANK forecast:

Tier: Loans > $1 Million

BYLINE BANK forecast:

Project State: TX

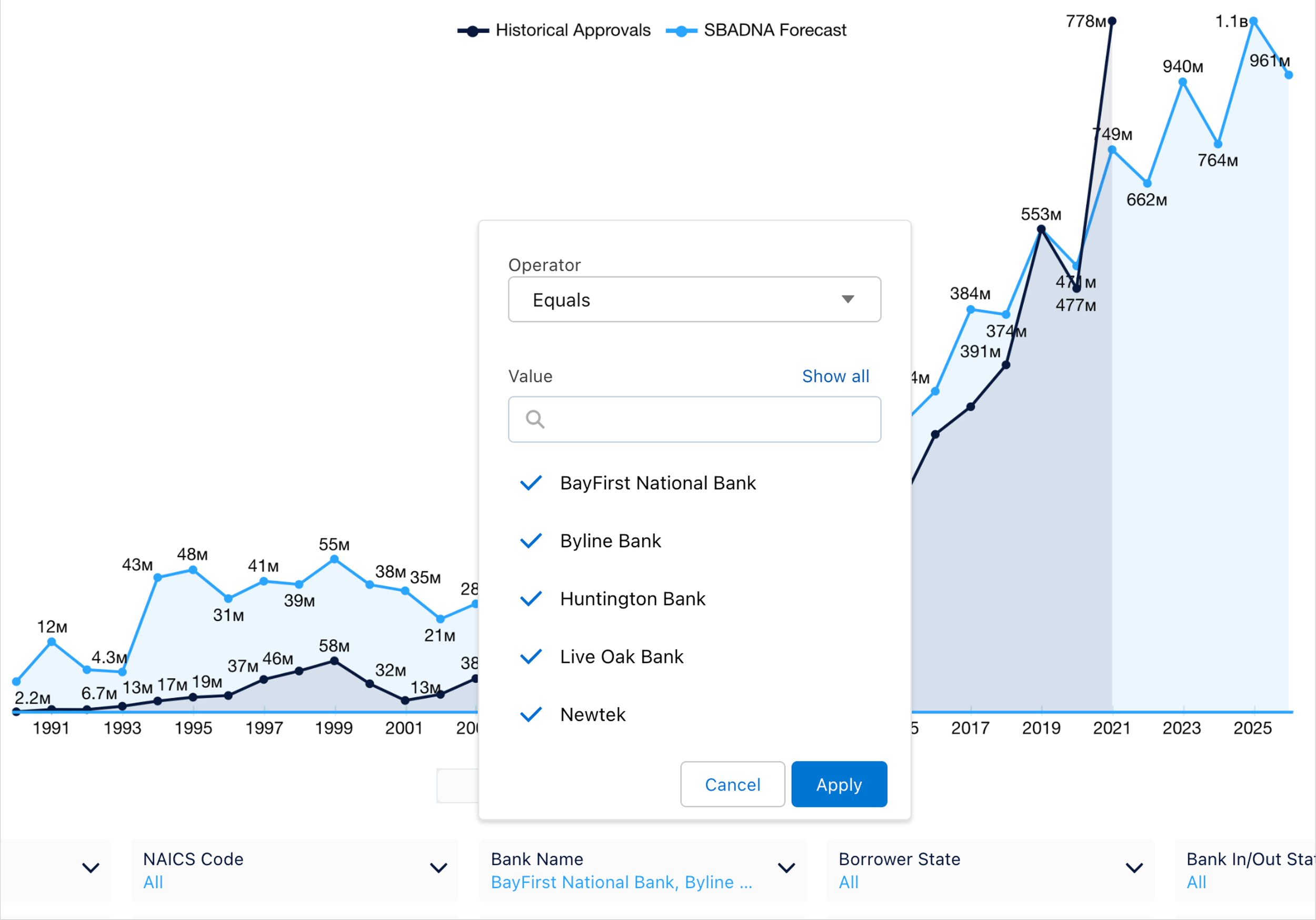

What’s the forecast for a specific grouping of banks?

For example, you have 5 SBA lenders that you want to emulate or you want to use the top 5 ranked lenders. It doesn’t matter which lenders or for what reason, you can use the Bank Name filter, add any number of lenders, and see their combined forecast.

How is this useful? Top lenders see a lot more activity than those lenders doing a handful of SBA loan approvals per year. They typically have bigger SBA team staffs, more experience, and more dialed into what’s hot and what’s not in SBA lending.

You may want to look at how the top 5 (or any number) SBA franchise lenders are forecasted to do next year, or next year in Texas, or next year in Texas for Food Services and Drinking Places franchise brands.

FRANCHISE LOANS forecast:

Lender(s): Live Oak Bank, Huntington Bank, Byline Bank, Newtek, and BayFirst National Bank

FRANCHISE LOANS forecast:

Lender(s): Live Oak Bank, Huntington Bank, Byline Bank, Newtek, and BayFirst National Bank

Project State(s): CA, TX, FL, OH

Tier: Loans > $1 Million

Peers and Competitors

It’s easy to see what your peers and competitor SBA lenders are forecasted to do in SBA approval amounts, for any combination of filters. Are they trending up in loan approvals in your back yard? How are they trending for the industries, franchises, and locations that are most important to your bank?

Perhaps your bank focuses on Illinois and Indiana. You used to rarely come against Huntington Bank competing for a deal but you have had several lately. Is Huntington Bank now focused more on your territory? Let’s find out. Use Bank Name filter and select Huntington bank and select Project State filter and select both IL and IN.

It looks like Huntington Bank is gunning for your territory. They nearly tripled the approval amounts from 2020 to 2021 in your back yard and looks like they are now a more significant competitor of yours for the next few years.

industries

Filter for a single industry or for your bank’s top 5, 10, 20 industries. See forecast for your bank, for a grouping of banks, or for all banks… for any loan amount tier… in any location.

Or use to see industries that you may not have historically focused on that have very bright futures according to the forecasted SBA activity.

What’s hot and what’s not? What are your competitors and top lenders focused on that you're not?

Are the industries your bank has focused on over the last few years forecasting up or down? Are you perfectly positioned, or do you need to consider adding other industries to focus on?

Perhaps your bank focuses on Illinois and Indiana. You used to rarely come against Huntington Bank competing for a deal but you have had several lately. Is Huntington Bank now focused more on your territory? Let’s find out. Use Bank Name filter and select Huntington bank and select Project State filter and select both IL and IN.

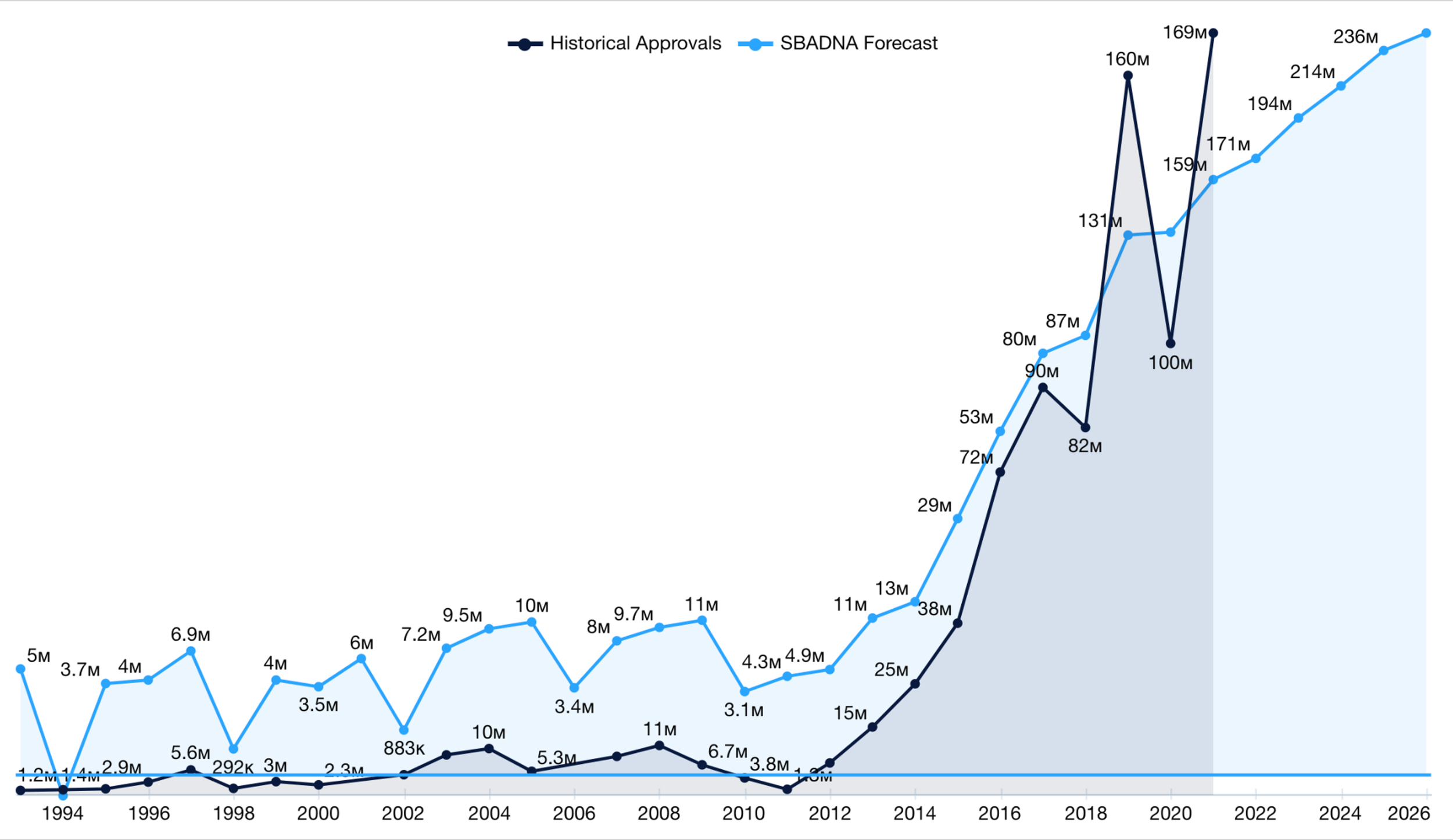

EXAMPLE:

Let’s say you did a car wash industry loan recently and want to do more of them Is this a hot industry? Is it a hot industry for your state? Is it a hot industry for your state for the > $1 million loan amounts you target?

FILTER(S):

Industry: Car Washes

FILTER(S):

Industry: Car Washes

Project State: TX

FILTER(S):

Industry: Car Washes

Project State: TX

Tier: Loans > $1 Million

industRY GROUP, SECTOR, & SUBSECTOR

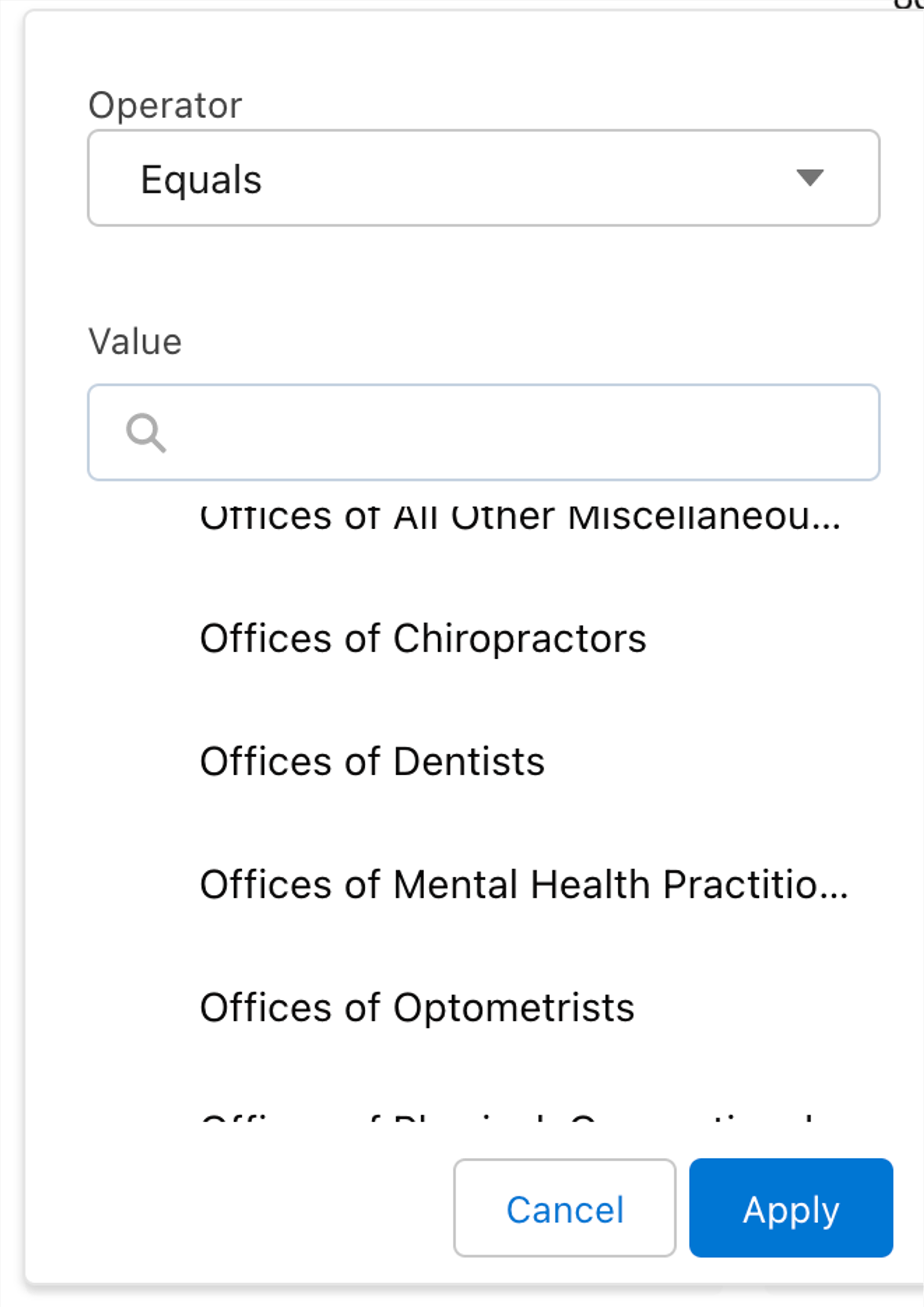

Because our filters are interconnected, when you select one of the filters, the others will then only show matches based on the previous filter(s) selected. Since we included industry group, subsector and sector data to our platform, you’re able to widen industry-based forecasts and identify new opportunities you may not be aware of.

We pulled the “Dentists” forecast but want to see other Industries in the same group. Since “Dentists” was already selected, clicking Industry Group, Sector, or Subsector will only show results pertaining to “Dentists.”

Now you can look at the forecast at broader industry perspective by de-selecting the other industry filters.

With interconnected filters, it’s easy to see the forecasts for other similar industries you may want to explore.

When Subsector is filtered for “Ambulatory Health Care Services” then when you open the U.S. industry filter it will show you all of the industries under this subsector.

This makes it convenient to see other similar industries you want to check the forecast on individually or any groupings.

FRANCHISE BRANDS

Filter for all franchise lending, a specific franchise brand, or a grouping of franchise brands. Filter for your bank, a grouping of banks, or all banks…for any loan amount tier…in any location… for any Industry, Industry Group, Sector or Subsector.

Or use to see franchise brands that you may not have historically focused on that have very bright futures according to the forecasted SBA activity.

What’s hot and what’s not? What are your competitors and top lenders focused on that you're not? Which franchise brands are red hot in the geographical area you cover?

Are the franchise brands your bank has focused on over the last few years forecasting up or down? Are you perfectly positioned, or do you need to consider adding other franchise brands to focus on?

franchise lending

Remember any filter combination used can then instantly become a franchise lending forecast based on those filters by selecting the Franchise Only button.

When you are looking at your bank’s forecast for different scenarios, you can click the “Franchise Only” button to see results for only franchise lending for the filters used and then click back to “All Loans.” This allows almost instant “franchise loan forecasting.”

Let’s say you pulled Huntington Bank forecast for Project State Ohio…

HUNTINGTON BANK FORECAST:

All Loans

Project State: OH

HUNTINGTON BANK FORECAST:

Franchise Only

Project State: OH

Specific Franchise Brand & Brand Groupings

Just like in the example shown with lenders you can pull the forecast for a single brand or a grouping of brands.

EXAMPLE:

You can see the forecast for Jersey Mike’s

EXAMPLE:

Or you can see a combined forecast for other similar sandwich show franchises to get a broader forecast view.

GEOGRAPHY

Filter for project state, project county, borrower state, city, address, and zip as well as bank address, city, state. Look at a specific state or a grouping of states. Filter for your bank, a grouping of banks, or all banks…for any loan amount tier…for any industry or industry group...and/or franchise brand.

Are there counties, cities, zip codes that you may not have historically focused on that have very bright futures according to the forecasted SBA activity?

Are the geographical areas your bank has focused on over the last few years forecasting up or down? Are you perfectly positioned, or do you need to consider adding other locations with desirable forecasted SBA lending activity to focus on?

Take California for example. Use the “Project State” filter and select “CA.”

Now that Project State: CA has been filtered, all of the other filters will only show data pertaining to Project State California.

Let’s say you want to look closer at the Los Angeles area. Select the Project County filter and only counties in California will show. Let’s select Los Angeles County.

EXAMPLE:

Project County: Los Angeles

EXAMPLE:

Borrower City: Los Angeles

Let’s say you want to look closer at the Los Angeles area. Select the Project County filter and only counties in California will show. Let’s select Los Angeles County. You can then continue with any other filters that are important to you about Los Angeles SBA lending.

Use any combination of filters for single or multiple locations.

EXAMPLE:

Project State: CA

Project County: Los Angeles

Borrower City: Los Angeles

Tier: Loans > $350,000

EXAMPLE:

Project State: CA

Project County: Los Angeles

Borrower City: Los Angeles

Tier: Loans > $350,000

Subsector: Food Service & Drinking Places