HOW TO HARNESS

RESEARCHING A FRANCHISE BRAND

The two key concepts about Intel Dashboards:

1) Every Intel Dashboard can become a Franchise Lending Intel Dashboard

2) Every Intel Dashboard can become a “UPS Store Intel Dashboard”

This page covers the various ways to research different aspects of a franchise brand’s SBA lending activity.

Intel Dashboards makes it easy to research a franchise brand. It may be a brand you have loans out with already or one that you are considering targeting for a relationship.

We have different dashboards that focus on different categories but some of the same intel about a franchise brand will be able to be found on any dashboard. In short, there can be multiple “right” ways to find the intel you’re looking for.

Intel Dashboards can be used from either macro or micro level perspectives.

You may be just trying to get a 30,000 feet view of franchise lending or a specific franchise brand(s). Intel Dashboards are going to show you what you’re looking for in seconds.

You may want to dive deep into the intel available for a specific franchise brand (which also only takes seconds to see). Intel Dashboards offer an infinite number of rabbit holes you can go down.

Whichever level of research (macro or micro) you’re doing, we’re going to show some of the dashboards to use and how to use them for examining a specific franchise brand.

For our example franchise brand, we’ll use The UPS Store. Why this brand as an example? Because they are currently the most active franchise brand in SBA lending based on number of loans. They’re a brand everyone knows. Their recent activity over the last two years is different than historical SBA lending activity.

Every Intel Dashboard can become a Franchise Lending Intel Dashboard

Every Intel Dashboard has a “Franchise Only” button where you can switch from ”All Loans” to “Franchise Only” loans.

When Franchise Only button is selected then the entire dashboard changes to only report SBA activity for franchise branded businesses.

EXAMPLE:

With “All Loans” selected in the upper right corner, we will get results of every SBA loan over the selected time period. In this case, 5 years.

(Click Image to Expand Dashboard)

EXAMPLE:

With “Franchise Only” selected in the upper right corner, we narrow our results specifically to franchise lending over that same pre-selected 5-year period.

(Click Image to Expand Dashboard)

Every Intel Dashboard can become a “UPS STORE LENDING Intel Dashboard”

Every Intel Dashboard becomes a “UPS Store Intel Dashboard” when you filter for “The UPS Store”. Most all dashboards you select will have a dropdown filter section at the top or bottom of the dashboard.

CHOOSE YOUR FILTER(S):

Select the Franchise Name filter

Start typing the name of the brand

Select the brand name

Click the “Apply” button

(Click Image to Expand Dashboard)

SEE THE RESULTS:

Now, the whole Dashboard report is only displaying SBA lending data for “The UPS Store”.

(Click Image to Expand Dashboard)

FURTHER:

You can also click the ranking chart bar to turn the rest of the dashboard into a “UPS Store Intel Dashboard.”

(Click Image to Expand Dashboard)

Get Perspective with Dashview Dashboards

It’s easy to get perspective on a brand with the Dashview dashboards. Click different time periods to see how the dashboard changes. Click each of the last 4 or 5 quarter buttons to see recent context on the brand’s SBA activity.

Get perspective on historical and forecasted activity, loan amount tiers, where the lending is happening, and which lenders are actively lending to the brand.

THE UPS STORE: ALL-TIME

(Click Image to Expand Dashboard)

THE UPS STORE: LAST QUARTER (Q3 2022)

(Click Image to Expand Dashboard)

GET PERSPECTIVE WITH historical lending activity.

Look at the forecast model to get a sense of historical activity, how the brand is trending and if the forecast is positive.

GET PERSPECTIVE WITH SBA activity by loan amount tiers.

Is this brand doing loans in the amounts you’re targeting?

Notice that all-time just over half of UPS loans were between $150,001 to $350,000 but in Q3 2022 almost the same percentage was for loans in the next tier up $350,000 to $1 million.

If The UPS Store was a franchise being avoided because your bank doesn’t target loans under $350,000, things have now changed. The UPS Store is now an ideal brand for loans between $350,000 and $1 million.

LOAN AMOUNT TIERS: ALL-TIME

LOAN AMOUNT TIERS: Q3 2022

Get perspective on which lenders are focused on this brand.

Is there one prominent lender with most of the market share of the brand’s business? If so, this indicates that lender has some sort of referral relationship with that lender.

Or are there a bunch of lenders and no lender has captured any significant percentage of the market share? This indicates a franchise brand to lender referral relationship may have potential to be established.

For UPS in Q3 2022 you can see that the lenders are spread out with none having significant market share. If you look at the Trailing (the T12 time period button which shows the last 4 quarters) and you see the same.

LENDERS: ALL-TIME

LENDERS: TRAILING 12 MONTHS (T12)

While Cadence Bank is the top lender over the last 4 quarters, if you scroll over the bar next to Cadence Bank the popup window shows Cadence Bank’s market share of approval dollars is 13.7%.

This indicates that UPS is not referring most of their SBA business to one lender.

This perspective reveals a potential business development opportunity for targeting.

A BIT MORE ON LENDER INSIGHTS...

Since Cadence Bank is the recent year top lender, you can click on Cadence Bank to see exactly what they have done with UPS Store lending lately or over any time period.

For further UPS Store lender details, you can dive into Lender Rankings and Lender DNA dashboards.

(Click Image to Expand Dashboard)

Use the Different Dashview Dashboards for Different Perspectives

By using different Dashview Dashboards you can generate robust intel from different perspectives. For these dashboard examples the dropdown filter at the bottom right of the dashboard for Franchise Name was selected to The UPS Store.

These are additional Dashview Dashboards for The UPS Store.

THE UPS STORE: INDUSTRY ALL-TIME

(Click Image to Expand Dashboard)

THE UPS STORE: INDUSTRY FY 2022

(Click Image to Expand Dashboard)

THE UPS STORE: GEOGRAPHY T12 (NATIONAL)

(Click Image to Expand Dashboard)

THE UPS STORE: GEOGRAPHY T12 (CALIFORNIA)

(Click Image to Expand Dashboard)

THE UPS STORE: FRANCHISE ALL-TIME

(Click Image to Expand Dashboard)

THE UPS STORE: FRANCHISE LAST 2 YEARS

(Click Image to Expand Dashboard)

The UPS Store: SBA Activity

For just the numbers, go to the Counter dashboard.

Click the Franchise Name filter and select The UPS Store. Click through years 2018, 2019, 2020, 2021, and T12 and see how the volume, average loan amount and rate spreads change.

(Click Image to Expand Dashboard)

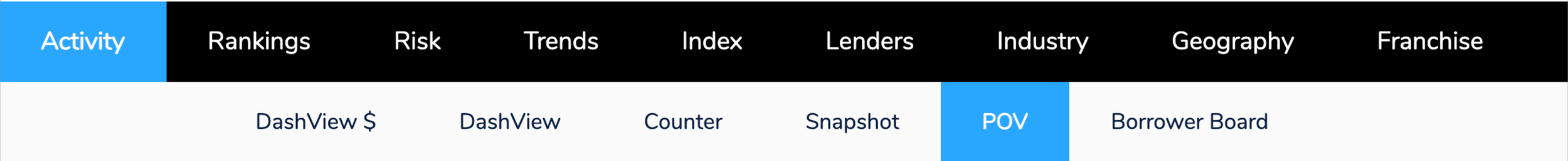

For the details on activity, go to SBA POV (Point of View).

SBA POV Dashboard makes it easy to see SBA activity by lender, sector, industry, state, city and more.

(Click Image to Expand Dashboard)

Another way to see SBA activity at a glance is the Top 20 Dashboard.

Click the Franchise Name filter and select The UPS Store.

(Click Image to Expand Dashboard)

The UPS Store: CHARGE-OFF RISK

The Charge-off DNA Dashboard will show you a more comprehensive view of historical charge-off risk.

See the charge-off data when any of these filters are used like, state, county and loan amount tier.

Click for charge-off numbers and dollars and the percentages of each.

Jump to different 10-year time periods.

(Click Image to Expand Dashboard)

Head over to the Counter for total charge-off numbers not based on a 10 year period.

(Click Image to Expand Dashboard)

The UPS Store: forecasts

While forecast charts are included in some of the other dashboards, the Forecast Model gives you a full screen forecast. Filter Franchise Name for The UPS Store.

See trajectory and the SBADNA forecast.

(Click Image to Expand Dashboard)

Use any additional filters that interest you.

(Click Image to Expand Dashboard)

(Click Image to Expand Dashboard)

The UPS Store: lender benchmarking

Use the Index Benchmarking Dashboard to see how what your bank’s activity compares to the activity of the average bank, average top 100, 50 and 20 bank, and average credit union, for The UPS Store SBA lending.

(Click Image to Expand Dashboard)

The UPS Store: COMPARE BRANDS SIDE-BY-SIDE

Use the Franchise Compare Dashboard to compare The UPS Store side-by-side with any other franchise brand. Just select which franchise brands you want to compare and over what time period.

(Click Image to Expand Dashboard)

(Click Image to Expand Dashboard)